Do you want to know about P2P payment apps? Great! You have landed on the right page. Read this blog and know everything about P2P payment app development.

Being a startup, you might have got fascinated with the trend of online payment systems. And why not if we have P2P payment apps like Venmo & Zelle that have eliminated the need to carry cash every time.

Now, we all own a digital wallet linked to our bank accounts, and we can make any big or small purchases with just a click.

No wonder these apps are great, but what if you can make payments simply via mobile numbers. These apps are not all-around utility players. Right now, entrepreneurs are planning to develop such payment apps, especially where you can pay via mobile number.

Such P2P payment apps have gained popularity in the last few years and made huge profits.

Considering the current market scenario, you can find immense opportunities in the online payment world. The global P2P payment market size accounted for $1,889.16 billion in 2020, and now it’s all set to reach $9,097.06 billion by 2030, growing at a CAGR of 17.3% from 2021 to 2030.

So, if you also find the P2P payment app development idea profitable and thinking of investing in it, then continue reading this blog.

Here, I’ll provide you with a detailed guide on P2P payment apps and the benefits, types, essential features, and final cost estimation.

I am sure that this guide will help you better understand the online payment world, plus find you the right app development vendor. So, without further ado, let’s start this app development ride.

An Overview of P2P Payment Apps

P2P or Peer-to-Peer payment system is an electronic payment system made by one individual to other individuals via their mobile devices with the help of an application called peer-to-peer applications. Anybody can get started with a P2P payments app easily, you just need to add bank details.

Nowadays, the process has become more simple, adding a mobile number and selecting the bank is enough. The app will fetch the rest details on its own except the confidential ones.

Securities are always given priority. That’s the reason why the app enjoys special popularity among youth.

Types of P2P Payment Apps:

We saw what P2P applications are, now, let’s explore their major types:

1. Standalone Services

These online payment applications have their mechanism for storing and dealing with money with no link to any financial institution. They don’t rely on any bank, instead, they have their wallet features that make it possible for users to keep money safe before transferring it over to their peers or offloading it into any other destined bank account.

PayPal is the best example here, its user base has grown to 202+ countries where there are millions of users making thousands of transactions every year, on average via 100 different countries.

Additionally, Venmo is also a popular standalone payment app. PayPal owns this popular app and has grown immensely in 2021. It witnessed a growth of 58% in its total payment volume.

2. Bank centric

A P2P application that keeps banks as one of the parties in the transaction is given the title bank-centric peer-to-peer payment app. This app type has majorly two categories. Take a look.

- First, banks have their mobile application.

- The second is a P2P application that sends funds via different financial sectors like credit unions, financial security businesses, and partner banks.

The best example of a bank-centric P2P payment app is Zelle, developed by US banking institutes, and it matches all the safety standards of banking establishments.

The app directly draws and deposits money into the user’s bank account instead of any account that has stored the amount.

3. Social Media Centric

The social media giants developed the next P2P payment app type to make transactions simple like never before. In 2015, Facebook launched its payment app called Messenger, where users can add their bank details to send and receive money.

Snapchat also launched its payment platform called Snapcash. However, it shut down soon in 2018. Following the same path, Google joined this race and launched its online payment application called Softcard. It’s a mobile wallet platform and a joint venture of Verizon, AT&T, and T-Mobile.

What are the important features of a P2P Payment application?

After knowing the P2P payment app types, it’s time to understand the essential features that make the app successful in the market.

1. Digital Wallet (E-Wallet)

Keeping a special place in your application for storing bank cards is a major feature of P2P payment apps. It provides users with the ease and convenience of making transactions in just a go of clicks. So, always add this feature to your P2P payment for a better user experience.

2. Transfer via Mobile Phone

The most important feature to add is if you want to outrank your competitors. This feature lets the users make transactions simply via mobile number. The registration process only needs your mobile number, and you can send or receive funds in your bank account via your mobile number.

3. Real-Time Payments

Real-time payments are simply referred to as payment rails (the platforms like Venmo, and Zelle via which payments are made). They are real-time which means, or at least very close—initiating, clearing, plus settling in a matter of seconds.

4. Transaction History

The next feature to consider in P2P app development is transaction history, it provides a summary of transactions made by the users.

5. Send Bills and Invoices

The bills and invoices are vital everywhere to show the transactions’ proof. Once in a while, each of us gets stuck in a situation where we need the details of specific transactions. All we do is recall the payment app and find the payment details. This process is a bit complicated, and that often frustrates the user.

6. Unique User ID/OTP

Another important feature for the enhanced user experience and strong security is OTP. It’s one of the easiest yet most effective ways of making payments with security.

For example, you might have been asked to share OTP to the shopping site or own while making a payment. A temporary password valid for 5-10 minutes makes the transaction successful via an app, and developers can also add a fingerprint to make it more secure.

7. Currency Conversion

Yes, we can visit currency exchange offices, but the same thing is also possible online. This option is much safer plus faster. Users can exchange currency between their debit and credit

cards in different currencies.

8. Push Notifications

Push notification is the quickest way to inform users about the payment.

For example- anybody can request money via an app, and you’ll get notified. You can transfer money simply with no delays. It can also send payment reminders like water bills, mobile bills, etc. This reminds you about your upcoming bill, which you can pay before the last date.

9. Customer Support And Chatbots

The most important thing for every service provider is customer support. The instant resolution of customer queries boosts the satisfaction rate and keeps them coming back.

A chatbot is the most trusted customer support technology you can use for your P2P app, and it will provide real-time assistance and keep your users engaged.

10. Cryptocurrency Payments

Cryptocurrency is the most trending technology available today in the market. It’s a digital currency via which you can make purchases online. Adding this modern feature can be beneficial for your business.

11. Admin Panel

The core feature of any app that operates the whole app is the admin panel. It will manage your whole application, where you can add, customize or remove any feature. Though, this feature is all for the app owners to make their operation simple.

Step To Step Guide to Develop P2P Payment App Like Venmo & Zelle

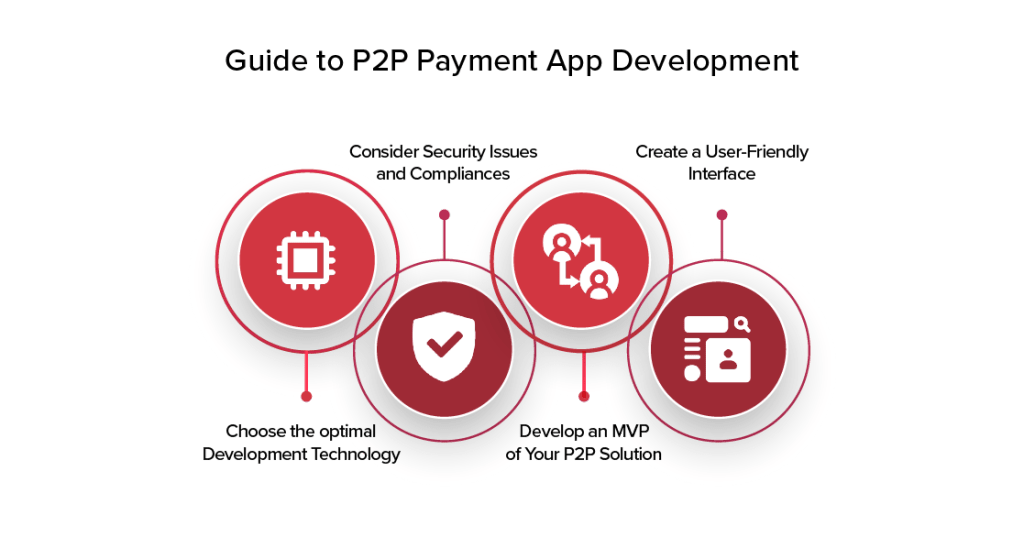

Now, it’s time to start the P2P app development process, so let’s dive intimately into the steps.

1. Choose the Optimal Development Technology

We always believe that app development technology lays the foundation. The right tech stack can make your business and vice versa.

There are various technologies available in the market that possess different features. Some are native, hybrid, and cross-platform app development technologies.

Have a brief look into these once:

Hybrid Applications

Hybrid apps are compatible with various operating systems (OS) like Android and iOS. Its development tools adopt the strategy of writing a single code and using it for all the targeted OS. This saves time and costs both.

Popular Hybrid App Technologies- React Native, Xamarin, Adobe PhoneGap, and Ionic.

Native Applications

Native apps are coded in a specific app programming language such as Java for Android or Objective C for iOS. These applications are fast and possess a high-reliability level.

Popular Native App Technologies- Swift, Java, C++, PHP, PhoneGap, and HTML5.

Cross-Platform Applications

Cross-platform apps are also compatible with different operating systems. This may resemble hybrid applications but both apps are different.

There are various cross-platform tools available in the market that can provide native-like performance. The development process is comparatively lower than native.

Popular Cross-Platform App Technologies- Flutter, Ionic, React Native, Xamarin, and Node.

2. Consider Security Issues and Compliances

The next foremost thing in the P2P payment app development is security. It implies strictly in the finance world. If users find a single security flaw, they will leave the app immediately and switch to the competitor. Thus, always add the option of hiding the user’s confidential details like debit/credit card CVV, transaction pin, etc.

Every country or economic grouping has its specific rules and regulations that an app must comply with otherwise, it will never succeed. The mobile app development team reviews compliance regulations such as PCI-DSS, data encryption, and two-factor authentication. Besides, we also recommend you to decide again on the target region.

Below are a couple of examples of authorities where you need to resolve legal issues by region:

- European Union – Directive (EU) 2015/2366 + GDPR compliant

- The UK – Financial Conduct Authority.

- US – Depends on the state

- China – FinTech Committee under the People’s Bank of China (PBOC)

- Australia – Innovation Hub by the Australian Securities and Investments Commission (ASIC)

- Korea – FinTech Center under the Financial Services Commission (FSC)

3. Develop an MVP of Your P2P Solution

The next step of P2P payment app development is MVP. A Minimum Viable Product or MVP is simply a development method where you decide the apps’ core functionalities.

Many expert developers suggest designing MVP first to know the idea of basic functionality. It saves time and costs both.

Additionally, the early designing of MVP will let you do app testing earlier on the users and get their feedback. If the user responds positively, you can finalize the MVP to the full app version. It will also increase the app’s success rate in the market.

4. Create a User-Friendly Interface

Users always like simple and convenient applications. They find it easy resolution of their problems. People only want easy navigation with fewer instructions and no time wastage.

The interface should always look visually appealing plus intuitive to users. The designer team also creates several prototypes, from low-fidelity to high-fidelity.

Final Cost Estimation

P2P payment apps vary from business to business. It’s not necessary that every business choose the same app type. Few chose bank-centric apps whereas few like social media-centric and some find the stand-alone service app the best. This all together leads to different app development costs and timelines.

But being a startup, you may need to have an idea of the cost. So, let me brief you precisely about the factors and final estimated cost.

The development process begins with the estimation & research where the development team collects all the information and frames the app idea. From here, they proceed to the development stage and work dedicatedly on the P2P payment app development.

Once the app is developed fully, it’s time to test the final application and launch it to the Google and Apple App Stores. The best app development companies always provide post-app development support services for a limited time. This helps you startups to learn all the important technicalities of the application and provide your customers with better services.

By summing all these factors, the overall cost looks like this:

- Simple P2P Payment App with 3rd Party Payment Processor- $30K to $40K

- P2P Payment App With Own Payment Mechanism- $150K-$200K

- P2P Payment App With Social Media- $60K-$100K

So, that’s how the development process will cost you with different timelines. Generally, it takes a time period of 5 months or even more.

How does QuyTech help you to develop P2P payment apps like Venmo & Zelle?

QuyTech is a decade-year-old company that just launched its P2P payment app named BayanPay. The app enjoys greater popularity and helps the client in accomplishing business goals with the highest satisfaction rate.

We as a company achieved a great milestone in serving 700+ global clients with pride. Being a team of 150+ prolific developers, we always strive hard to give clients the best to become standouts in the global market.

Let’s have a brief look at our USPs:

- Blockchain, AI, AR, VR, and other tech-powered applications

- Tailor-made applications

- Complete transparency and no hidden cost

- Up to 60% savings on app development cost

- Develops robust applications compatible with different OS

Get your robust P2P payment developed – Get in Touch

Final Thoughts

P2P payment applications have created a buzz in the world of mobile apps. Being a part of the fintech industry, having your own business P2P payment app can give your brand a competitive edge in the market.

With the above P2P app development guidance, you can get quality plus effective mobile application development. There are certain factors that determine the success of the app, so make a note of it and get your brand global recognition from any corner of the world.

I hope my blog helped you in understanding the concept of a P2P app and its development process.

If you have any queries or want to know more about it, let me know in the comments. Our experts will get back to you and provide you with the solutions.